Considering how important peak oil is to our society and our future, I’m constantly amazed at how few people have heard of it, much less understand it. I’m no expert on the subject, and most of the information in this piece comes from the Internet – I won’t even bother to reference much, you can get it all from Wikipedia. But I thought a brief summary of the issues involved might raise the level of debate when the issue comes up.

What is peak oil?

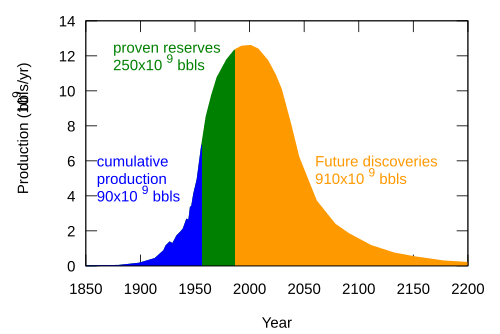

Peak oil is simply the point at which petroleum production is at its historical and future maximum. It is not an end to oil production, only a point in time when the market changes dramatically. In fact, it’s roughly the point at which half of all oil that will ever be extracted has been extracted. The consumption of oil has increased almost continuously from the day a use for it was discovered, and at the point of peak oil this will have to change.

Peak oil is simply the point at which petroleum production is at its historical and future maximum. It is not an end to oil production, only a point in time when the market changes dramatically. In fact, it’s roughly the point at which half of all oil that will ever be extracted has been extracted. The consumption of oil has increased almost continuously from the day a use for it was discovered, and at the point of peak oil this will have to change.

What happens at peak oil?

When we hit the global peak of oil production, oil prices will increase until demand drops. This is not just fundamental economics, it’s the only outcome physically possible. If demand is at or above the level of peak production, and production drops, demand must drop since the amount of oil available can not meet this demand. Once oil becomes scarce and expensive, if society has not adjusted to other technologies then the effect on economies will be dramatic.

The Hubbert Curve

In 1956 M. King Hubbert published models that predicted the US would hit peak oil production between 1965 and 1970. Not only was he correct about production in the US, the Hubbert curve has been successfully applied to oil producing countries around the world. The model doesn’t just apply to a prediction of a country’s oil peak, but also to a global peak for oil production.

Predictions of the Peak

The International Energy Agency has estimated that the world has hit peak oil in 2006.

The US military is the world’s single largest user of oil. The Joint Forces Command published the Joint Operating Environment 2010, stating “By 2012, surplus oil production capacity could entirely disappear, and as early as 2015, the shortfall in output could reach nearly 10 million barrels per day.”

A survey of petroleum geologists was published in the journal of the Society of Exploration Geophysicists in 2008. 61% of petroleum geologists believe peak oil has occurred or will occur within the next 10 years. Only 15% give us over 20 years until peak oil.

Both Exxon and Shell have admitted that almost all of the easy and cheap oil in the world have been found.

Can’t we just drill, baby, drill in Alaska?

Alaska has known reserves of oil, and therefore is already accounted for in these predictions. Remember – peak oil means roughly 1/2 of the oil we’ll ever extract is still in the ground. It’s assumed we’ll open up more of our reserved oil at some point in the future, and the question is whether it’s more useful to use our supply before or after prices go up.

How does this affect Seattle?

Our land use and transportation decisions affect us on the decade or even century scale. Although it’s really hard to predict the future, the success or our decisions depend on this prediction. I don’t predict cars will go away. But driving them will become more and more expensive. And paving our roads will become more and more expensive. We can either prepare for this future now, by building densely and connecting dense nodes with electric transit, or we risk hitting a wall and having a large amount of our population lose much of their mobility.

This argument is entirely based around oil being the only workable fuel for cars, which we know is not true (at the airport there are CNG taxis, and sanctions-era South Africa ran all of its cars on liquefied coal). It’s sort of like looking at the decline of movie theatres and say “yup, movies are on the way out”, without considering there are other places to watch movies, for example, your 60 inch plasma. The reason oil is important is that it’s magic. The beverly hillbillies poke a stick in the ground and we can run civilization on that black gold. It’s much harder (ie, expesnive) with coal, but it’s not impossible.

The problem isn’t that we’re not doing enough to plan for the eventuality that cars disappear, it’s that planning all of our infrastructure and land use around the automobile is needlessly inefficient (and environmentally destructive). Roads are expensive, operating cars are expensive. Compared to these, transit is very cheap.

Also, your “fundamental economics” are wrong. Oil prices will always equal the marginal cost of extracting an extra barrel of oil, regardless of what the demand is. This is P=MC, and is a fundamental law of economics. At some point, the MC(oil) > MC(coal) or MC(oil) > MC(NG) (or some other fuel), and we'll begin to see a shift away from oil (we may have already reached that point in a small way).

Demand in the Economics sense can only decline when people shift away, it cannot decline from a rise in price, in that case the demand is still there, but it intersects supply at a lower point on the demand curve.

A shorter summary of my comment: nobody makes a big deal about peak oil because it actually isn’t a big deal.

Oil was important because it was the cheapest fuel, as it becomes more expensive because we found all the easy oil, it becomes less important, and we move to other fuels. There’s no risk we’ll run out of fossil fuels: we’ll destroy the earth burning them first.

So why is peak oil not a big deal? If you look at the stuff more closely it’s hard not to contend that there is no combination of alternatives that can fully replace oil in terms of quantity and quality. Now that we’re approaching peak, the big question is what happens on the decline side of the curve? People tend to underestimate what even a 2%/year decline of oil production would mean in terms of amounts of liquids and energy to be replaced.

Example: The US uses 18 million barrels per day. An average car uses 581 gallons = 13.83 barrels per year. Therefore you would need to replace 18,000,000*0.02/(13.83/365) = 9.5 million oil-powered cars per year with something else (cng, electric, hydrogen?) to maintain the same level of activity. Is that realistic?

Since there are no ready and scalable substitutions for oil there will be a major, and, over time, accelerating curtailment of economic activity. That is a big deal.

Preparations for scalable adjustments take two decades (at best) while peak oil takes a few years to turn from plateau to relentless decline.

http://www.netl.doe.gov/publications/others/pdf/oil_peaking_netl.pdf

We’re already responding to this.

First, VMT is on the decline:

http://www.fhwa.dot.gov/pressroom/fhwa0905.htm

Second, cars are more fuel efficient:

http://www.bts.gov/publications/national_transportation_statistics/html/table_04_23.html

Neither of these has lead to a “curtailment of economic activity”. What if Safeway carpooled groceries to your house instead of you driving there? Oh wait, that exists. What if I could meet colleagues in India without flying there? Oh wait, that exists. There are a lot of ways to be “economically active” without driving a car, and we’re doing many of those things, and we’ll figure out more.

Certainly, better land use and transit are a good idea. I didn’t start this blog to argue against that. And rising energy costs are going to have an effect. But peak oil is a huge red herring.

No curtailment?! Haven’t we had this little recession that among other things pushed oil use from over 20mb/d to 18mb/d? Partly by reducing VMT and causing reduction of VMT. The price relief was very short-lived. And we’re just approaching the oil production plateau. Again, what happens on the descent side?

Just as there is no risk of yeast on a petri disk ever running out of agar. If you believe otherwise, then it should be no problem for you to give me a barrel of fossil fuel for every square on a chess board, where one barrel is granted for the first square, two for the second square, four on the third square, eight on the fourth square, and so on up to 64 squares, or really on to any number of other chess boards, if, as you so claim, humanity will never run out of fossil fuel.

Another neat feature of the exponential function is that at every new chess square, more than the sum of all previously consumed fossil fuel must be discovered and consumed: at three squares, four is one plus the sum of all the previous squares (1 + 2), at four squares, eight is one plus (1 + 2 + 4), five squares 16 = 1 + (1 + 2 + 4 + 8), and so on. This brings us to the doubling period, or the time required to step from square to square. Yeast manage a fairly rapid doubling period; humans can double their growth on the decade or century scale (approximately 72 divided by the yearly growth rate), which delays, but does not eliminate, the inevitable exhaustion of the non-renewable resource in the face of any growth in demand for it.

As for the yeast, when they are done doubling, there will doubtless be some agar left, confirming the truth that there is no risk of them ever running out of yeast. There will also be no yeast left to enjoy this truth, the last having died in their own waste.

So, is humanity any wiser than yeast?

This is why it is so important to raise the gas tax. We need to get ahead of that 20 year curve. It will (a) resign people to more efficient vehicles and (b) provide an income source to fund research in alternatives. We can also use it to fund better transit in areas people are in a position to give up their car entirely.

Wait, you are saying the recession is because of oil prices?

Even then, we’re still richer than we were in 2000. Those in India and China are a whole lot richer, so I’m not even slightly convinced by what you are saying.

Moreover, if Oil = economic activity, you are repeating the republican line that we can’t reduce emissions because it will hurt the economy. I think most people here disagree with that.

@Jeremy: Humanity is more flexible than yeast. Yeast runs out of agar because that’s the only thing it can eat, and because all the agar is easy to get until there’s none left. We won’t exponentially increase fossil fuel extraction as what remains becomes harder and more expensive to extract, we’ll… well…

The optimistic theory says that awareness of the problem and rising costs of fossil fuels will impel us to shift to other energy sources long before the fuels run out (so there will be oil there and it will be used in small quantities for applications where nothing else will do), and that human population will level off for peaceful, natural reasons pretty soon, ending the exponential increase in consumption. The pessimistic theory says that awareness of the problem and rising costs of everything will cause starvation and resource wars, decimating our standard of living, our ability to summon the economic power to extract very much oil, and the human population, long before the fuels run out. Reality probably lies somewhere in the middle.

Jeremy, your analogy is crummy because we’ll have burnt the earth to a crisp before we will have burned all the fossil fuels. Our consumption path is unsustainable because we’ll all die, not because we’ll run out of fuel.

If it was only as simple as running out of fuel we wouldn;t even care about global warming.

Andrew, with respect to “VMT is on the decline”, I think you mean “in the US”. VMT is increasing worldwide faster than ever before — the RATE of increase is the fastest ever. The number of cars and the number of miles driven are likely to double in the next 15-20 years or maybe even less, depending on global economic recovery.

The problem I see with the concept of “peak oil” is that if the supposition that all the easy oil has been found is true, it does not follow that the extraction of “hard oil” is necessarily going to fail to make up for it. There are a LOT of oil sands being discovered, a lot of oil left in marginally productive wells that magically appears and disappears depending on whether the BBL price is higher than the extraction cost or not, and a planet full of unexplored ocean.

More expensive oil, yes, but not “no oil”.

I’m not saying the recession was caused by oil. IMO it was exacerbated by high oil prices. It was just to show that energy use and economic activity are strongly correlated and that a ~13% drop (20.8mbd to 18mb/d today) in use over a few years doesn’t come without sustaining major economic damage.

If I understand you correctly, you’re saying it’s perfectly possible to avoid major damage by deploying efficiency and/or replacement fuels. I agree up to a point (the idea of a long-term decoupling of energy use and economic growth is a fantasy: http://physics.ucsd.edu/do-the-math/2011/07/can-economic-growth-last/ ). But efficiency takes time (on average a general 1% improvement every year) and gets harder (and then there is Jevon’s paradox). Overall, too slow to avoid curtailment if oil decline begins in this decade.

When it comes to the replacement fuels there is a misunderstanding about the quality and scalability of alternatives. They take time and massive investment and still provide less than the conventionals. Coal liquefaction? 5 years of building and $5billion will give you 70,000b/d plant. It’s being done and will be done but it’s peanuts. We all know the downsides of biofuels. The current natural gas glut is a bubble that won’t go on forever. Tar sands will never exceed 5mb/d. It goes on and on.

The way to understand this is an analogy to a related resource problem. If someone were to say ‘We will never have water problems because 70% of the planet is covered in water!’ he would be right up to a point. But 97.5% of that water is salt water that can’t be directly used. Only 1% of that 2.5% fresh water is readily accesible for human use. So you have a resource pyramid with the good accesible stuff on top and the abundant bad quality stuff at the bottom. That resource pyramid is turned upside down in daily use. The easy stuff provides most of the daily supply and the bad stuff a small fraction. E.g. more than 14,000 water desalination plants worldwide provide less than 1% of the water supply. This is not to discount the alternatives totally but to put them in proper context. No amount of money will change that unless we want to bankrupt ourselves (there it is again: curtailment).

Where are your numbers coming from mobilitor? I just heard on NPR of a 25,000 barrel per day plant in West Virginia and it was in the hundreds of millions of dollars in cost. Either way, I don’t think you proved your case, I think you proved mine.

Even at $5 billion, assume in the future (as you must I think) oil is $200/barrel. At that price, 70,000 bpd is $14 million a day or $5 billion in business a year, I don’t know what percentage is profit, but if CTL plants are already being built at $100, then at $200 I’d guess a significant portion would be profit. Math seems to make sense to me.

People forget 18 million barrels a day is hundreds of billions of dollars a year. Shit tons of money. More than enough to make $5 billion look like peanuts.

Andrew Smith: peak oil has meaningful economic effects. Yes, people will switch to electric cars, but even with future technology the *capital costs* of those cars will be larger (and the fuel costs less) than oil-burning cars, which will cause massive changes in the economy.

Because a large portion of the population is capital-constrained (which is a whole ‘nother economic issue…) this will also drive people to trains. It will drive people to buses, but the transit agencies who run buses are operating-budget constrained, and the trains are cheaper to run, as well as being nicer, so they’ll get the bulk of the demand.

Every investor needs to pay attention to peak oil.

You are of course right that we’re not going to run out of *coal*, and will instead drive ourselves extinct with global warming if we keep burning it. Peak oil means that people who want to prevent the disasters of global warming have to focus on stopping coal use (replacing it with hydro, solar, wind, geothermal); oil use will stop on its own.

It’s also important to note that the production cost of “really hard to get” oil is going to exceed the production cost of renewables within a decade.

Read the Deutsche Bank report on petroleum prices: they expect it to hit a point of demand destruction within 20 years, followed by a complete phase-out.

I actually agree with most of your comments. But I think you’re arguing against some stereotype of peak oil, rather than what I wrote.

“This argument is entirely based around oil being the only workable fuel for cars” Not in the slightest. We burn oil because it’s the cheapest stuff to burn. As oil becomes more scarce it will become more expensive. Yes, at some point it will become economical to switch to another fuel – but these other fuels won’t be as cheap as oil is now, or we’d be using them already.

“Oil prices will always equal the marginal cost of extracting an extra barrel of oil, regardless of what the demand is.” Sure. I’ll buy that. But as oil becomes more scarce, the marginal cost goes up.

“demand is still there, but it intersects supply at a lower point on the demand curve” Now we’re getting into semantics. By saying that demand goes down when prices go up, I mean demand at that price.

So this post’s title should actually be “energy prices are going to rise” and have nothing to do with peak oil? I can’t really see any other way around it. It’s either:

1) Oil is special/I don’t understand how fossil fuels work. Peak oil is significant.

–or–

2) Oil is one of three main fossil fuels and the one in the most limited quantity. Peak oil is interesting but not significant.

If you believe (2), why write a post with peak oil in its title?

This isn’t semantics, these are terms of art. If you say “economics” and start using economic vocabulary, it’s better to use the words correctly otherwise it’s confusing. For example, if I start calling Link “high speed rail”, because, well, it’s a fast train, you’d say “Wait a second, high speed rail is actual thing, and link ain’t it.” Same thing here.

I still think you have a biased view of what “peak oil” is supposed to mean. There are certainly corners of the Internet where you can find people planning what form of currency to use after the oil crash epocolypse. I do not subscribe to that view. My view is closer to #2, but it’s certainly significant. The other two fuels are far more difficult and expensive to base our mobility on. A world with expensive oil means a world with expensive transportation energy, and such a world is certainly significantly different from the one we grew up in.

Andrew, peak oil means major economic shifts.

It doesn’t mean “OMG disaster!” It does mean major economic shifts. People, companies, and cities which take advantage of those shifts will benefit; those which ignore them will be left behind, like Detroit.

Relevance to this blog? If the Seattle area focuses on providing electric-powered transportation on non-oil-based roads/trackways, it will have a major economic advantage in 10-20 years over stupid cities which put all their investment into gasoline and asphalt (of which there are many).

[ot – ad hominem]

Are you sure you didn’t hear gallons instead of barrels on NPR?

Is it this plant? http://www.americanfuelscoalition.com/2011/05/19/wv-ctl-sends-message/

$3billion for an 18,000b/d plant in West virginia. Sasol is studying a $10billion 96,000b/d GTL plant in Louisiana. The numbers I cited are from an plant that Sasol wanted to build in China for 80,000b/d (not 70,000 – my mistake) but it got canceled. A Chinese company is operating a plant there at 20,000b/d and wants to expand to 100,000b/d. At 10mb/d Chinese consumption you’d get a 1% share of supply.

All but two projects were canceled. Partially because the Chinese government doesn’t know where coal is supposed to come from, being the biggest coal importer – they need it for electricity.

http://online.wsj.com/article/SB10001424052748704132204576189744098917136.html

and the article below by Aleklett et al.

Assuming we go on a CTL binge, where do you get the resources? The national petroleum council / southern states energy board envisions 5.5mb/d by 2030 which would consume 1439 Megatons of coal annually.

http://americanenergysecurity.com/the-american-energy-security-study/

The EIA tells me that the US used 950 Megatons of coal in 2010. Is it realistic that the US or some combination of other countries will somehow get an additional 1000+X Megatons per year to get a few million barrels of synthetic oil per day? By the way, 3-4mb/d production capacity is lost every year in aging fields. Also, the places were the coal is (Wyoming, Southern Montana) unfortunately don’t have the water to run those plants on a big scale. It all hits practical limits even if we manage to build two or three of those per year to replace 1% (180,000b/d) of supply.

I hadn’t thought about the water part of it, Louisiana makes sense for obvious reasons but, as you said, it takes a lot of energy to get coal from montana to louisiana. I dunno, it may end up being that electricity is how coal powers cars?

Electricity will indeed be how coal powers cars, but thank goodness we are not expanding coal-burning electrical plants. Renewables, which are getting cheaper and cheaper to instlal, are the future of electricity.

But anyway, even if we power our cars with coal-generated electricity, it’s more carbon-efficient than using gasoline, due to the following facts:

(1) small engines are incredibly inefficient compared to large generators

(2) transportation costs for gasoline are massive, and for electricity are tiny

(3) refinery losses for gasoline are enormous

Nathanael,

Not a “complete phase out” unless you’re speaking exclusively about use of oil as a transportation fuel.

We are literally eating oil and natural gas in every meal, since they are the only suitable feedstocks for nitrate fertilizers. I suppose one could begin with coal, hydrate it to make hydrocarbons and then use the synfuel as feedstock. Eventually I expect hungry humans will be doing exactly that. But it will cause food prices to skyrocket.

That’s likely to be the primary limiter of oil consumption: there won’t be enough people with sufficient income to drive after the price of feeding oneself returns to 40% of average income.

In 1955 at age 10 I remember reading in “My Little Reader” that the world would run out of oil by 1975 and we should be considering other sources of fuel to power industry and transportation. Would that we had, the world would probably not be in the position it is now. Ending the use of oil and coal now would be the beginning of a solution.

They misunderstood at the time what Hubbert meant – just as many do now. People hear “peak” and think “running out after that”. So your reader got it right that we’d hit peak in the US by 1975, and we did. :)

Oil prices will always equal the marginal cost of extracting an extra barrel of oil

But the price of oil has ranged from about $78-$111 per barrel over the last year, which is hard to explain simply by P=MC. The fact that oil is traded as a commodity means that its current price is highly influenced by its perceived future marginal cost of production. The overall price trend in the oil market over the last 5 years has been UP, but the global demand for oil has also been rising quickly. So the oil traders are correct to believe that the current cost of an oil barrel should be on the rise if the markets are going to provide alternative sources of energy in the future–even if the USA chooses the Gingrich/Clampett ticket in November.

In oil’s case, P=MC is over simplifying things, mostly due to the OPEC cartel. New technologies and new reserve locations can explain some of this. We are also constantly getting better at finding new oil, and we’re getting better at extracting it. And we’re getting better at finding coal and extracting that. Most large players in oil futures are people hedging against large movements in price to reduce their business risks, not people gambling on the future cost of extraction.

The main thing is this: if anyone believed Matt’s theory that “oil is going to run out and we’re all fucked”, oil would already be way more expensive, because people would stockpile it for the day when that happened, especially if peak oil’s here and we can see that day. You could make a fortune doing this, and it’d be really easy: you just leave the oil in the Alberta tar sands or whatever.

These guys aren’t stupid; they’ve reasoned through this and think Matt is wrong.

From my understanding the reason oil prices are so variable is because of real or perceived risk in the availability of it and thus the finical return you can get off it. Its a commodity just like anything else and if you own something that suddenly because scares you’ll make more money off of selling it. With futures trading the market builds this risk into their prices.

I no economist but I think P=MC will only describe the *lowest* cost at which something will be available, lot the maximum.

PS interesting but somewhat unrelated. http://bit.ly/H4hoxc

I don’t see where Matt says or implies that “oil is going to run out and we’re all fucked,” but I can see that that’s an easier position to attack than the more nuanced one that he does make. We use petroleum products in automobiles because that’s the cheapest way to run them. Nowhere is it claimed that this is the only source of energy to run a vehicle- only that the rising price of that cheapest means will lead to the rising cost of operating them. Matt’s thesis is that that ongoing trend should be driving our land use decisions today. Who can argue against that?

I don’t see the fact that tar sands crude is being produced today as evidence that the producers don’t believe that the future price will be higher.

Yes, the risk is a business risk to people who need lots of oil, like airlines or whatever, so they buy and sell futures so they can hedge against those risks. It’s worth pointing out that oil futures and oil aren’t the same thing.

Price should equal marginal in a perfectly competitive environment, which oil isn’t because of OPEC. And it’s a simplification, but a useful because what drives price is cost. At some point oil is going to cease to be practical and we’ll move off it toward coal and natural gas, and oil will still just be priced at the cost of extracting it.

@S. Morris Rose

I read this as “oil is going to run out and we’re all fucked”. You may have read something else here; to me it’s pretty clear.

Not quitetrue. Electric or Biofuel (depending on the source) vehicles are cheaper to operate, but cost much more to manufacture – you have to be looking at the extreme long-term for it to be a personal financial payoff.

“because people would stockpile it for the day when that happened, especially if peak oil’s here and we can see that day” Isn’t that exactly what OPEC is trying to do, and has been since the 70’s? Isn’t that more or less what we’re doing in Alaska?

“we’ll move off it toward coal and natural gas” In the short term, natural gas is a possibility. Though there’s a large amount of investment we’d need to make and it’s likely this will run out fairly quickly as well. It’s also a lower energy density fuel – you can’t travel as far on a tank – so it won’t ever be appropriate for several uses. Coal is a big, big problem. It is an enemy to mankind. We will either be smart and ban the stuff, at least for fuel use where carbon capture can’t happen (and I’m yet to be convinced it can happen on a large scale for power production). Or we can not regulate the stuff and have a very, very warm future. Luckily, making fuel from coal remains difficult and expensive. But if we don’t regulate coal, it’s inevitable that it will end up being a transportation fuel (though at a much higher price than we’re paying now).

I’m not sure. There seem to be a lot of indications (at the bottom) that OPEC is actually selling oil faster than they might otherwise to keep oil as the main energy. Oil is actually worth a lot less when people start switching.

I agree with Matt here. The other fossil fuel alternatives are unsuitable for environmental and economic reasons. And peak oil is a sign-post, nobody is overplaying it as the end of the world.

[ot – ad hominem]

Thanks for the feedback, you’re right, I should cool it on the snarkiness. I have a severe hate for bad arguments and it turns me into a madman. Peak Oil is one of my serious pet peeves. That’s not an excuse for being terrible.

That’s the second post of mine in less than a week you’ve accused me of having bad arguments, simply because you disagree with me. Am I unwelcome here?

You are welcome*. I clearly misread your intentions in this post; the fight I picked was not with you but with a straw-man. I got a whiff of “Peak Oil will send us into the 18th century” (really a pet peeve of mine), and went beast mode. You didn’t say that, I misread it, and I’m sorry for insinuating that you meant that. I’m also sorry for writing 25 (or whatever) comments burning that straw-man to smithereens in a scorched-earth attack. My only excuse is I didn’t think it was a straw-man, but that you were the scarecrow who only needed … well, you know. I’m sorry for that, too.

The other post was different – I stand by my criticism that was poorly argued (I think I showed that with a hammer, and in that case I absolutely did agree with you). The follow up was more than convincing. I am sure I wasn’t appropriate then either, and I’m sorry.

Sorry for being a dick. In the future I’ll try to remove the stink and snark from my criticism. There’s a big difference between a variety of opinions and being a jerk.

* FWIW even if I didn’t like your stuff (I do, btw), Martin’s the arbiter of that, not me.

Thanks Andrew. No hard feelings.

Read the Deutsche Bank report. There’s a substantial speculative overlay on the long-term supply-and-demand-driven oil price, causing huge fluctuations.

Andrew,

People simply can NOT “stockpile it for the day when that happen(s)”. Well, more than they are now. The only practical large-volume storage facilities are emptied sulfur domes as are used by the Strategic Petroleum Reserve and which are currently nearing capacity. All the storage tanks in the very sophisticated and long-built US refining and marketing system are good only for about two months’ consumption.

“Stockpiling” is impossible; the way to ensure a future domestic supply is seriously to limit the shalers and keep most of what is left in Alaska and deepwater Gulf off the market.

Yes, we need to do some exploration and development in those environments in order to pay for further improvement in the technologies that enable access to those resources. But as long as oil is priced in

T-Bills we should print more and give trade them with the Arabs for oil.

You are either mad or stupid… the easiest way to stockpile it is to never dig it up.

Just a point to nitpick. The point of peak oil does not correlate to the median of all oil production. Peak oil is just the peak, not the mean. This is because as oil becomes more valuable in the future and technology to recover that oil becomes better, oil that is currently uneconomical or impossible to recover, becomes recoverable.

You’re probably right. I was basing that on the shape of the curves, but they’re a bit fatter on the right side. My general point is that many people see the peak oil argument as running out of oil, where as it really happens when we have plenty of oil left.

DDT and Alar were banned when it was determined that they were detrimental to human health. They were, at the time, the cheapest ways to control certain pests in agriculture. Cheapest wasn’t the best. Oil (read fossil fuels) may be the cheapest way to provide energy for vehicle propulsion and dwelling heating needs, but haven’t we discovered that burning fossil fuels is detrimental to this earth’s well-being? So ban the use if it, or at least the manufacture of new things that rely on it.

Banning new manufacture of things that rely on oil would mean we could manufacture almost nothing. Oil is everywhere. Oil isn’t harmful in the same way that DDT and Alar are, and a different scheme is more appropriate; a tax on pollution makes the most sense to me. I would, for sort of complicated reasons, make the tax revenue-neutral by collecting it, then writing every person a check for an equal share of the take.

As far as alternatives to oil as a means of maintaining “happy motoring,” all of them have production curves as well. Coal, LNG, CNG, etc. It’s a question of where we are on the curve.

Moreover, the key equation is EROI, or energy return on energy invested. As we move down the back end of Hubbert’s curve, it becomes more an more energy intensive to pull a barrel of oil out of the ground. At somewhere below 3 to 1 EROI, a source is simply not viable.

This is an interesting conversation. Sadly, it’s been shown we have enough coal for something like 300 years of current energy consumption. This means we’ll make the earth unlivable for humans long before we run out of fossil fuels.

This is why environmental campaigning needs to focus on stopping coal. The others will run out on their own; coal won’t, not until we’ve all been killed.

Has anyone seen the price of natural gas recently? It might be worth looking at energy costs regardless of source.

The headline of this article from yesterday is “The price of natural gas hits 10 year low.”

http://www.heraldnet.com/article/20120330/BIZ/703309899/1005

So, yeah.

Many more good ones.

http://www.bing.com/news/search?q=price+of+natural+gas+&qs=n&form=QBNT&pq=price+of+natural+gas+&sc=8-21&sp=-1&sk=

This is due to the fracking bubble. Which is a genuine bubble and won’t last; fracked fields run out in 5 years or so, much less than other natgas fields.

This article in Rolling Stone indicates that the current low prices are at least partially due to drilling being done to secure drilling rights. In short, if a driller doesn’t drill a lease within 3-5 years, they forfeit the right to do so. Thus, a lot of drilling right now is going on despite low prices.

The picture on the impacts, both environmental and economic, of fracking is still pretty gray in my mind, but I’m always suspicious of “low prices forever” kind of talk, especially when tied to a fossil fuel.

Fracking’s a disaster, and here’s why.

It just doesn’t actually generate that much gas. So, done safely and competently, it doesn’t really pay for itself.

Therefore all the fracking companies have a business model of cutting corners: polluting, breaking laws, cheating landowners, etc. — in order to generate large “first year” production numbers. *Then they resell the natural gas fields* to traditional gas companies, also known as “suckers”, collecting a quick profit. The suckers proceed to discover that they overpaid massively for the fields, because the frackers claimed the fields would last for 10-20 years, and they last for 5.

USGS showed that the frackers were overstating the amount of gas available; the “flip the fields” business model is in their annual reports. The abusive behavior towards landowners and casual attitude toward massive pollution and land despoiling has been well-documented, but it’s the economic incentives which cause them to *do* it.

IF you want to read about Peak Oil, this is the best short treatment I can find, written by a rather respected person at that:

http://crookedtimber.org/2006/03/23/carbon-too-much-not-too-little/

Read the whole thing.

Here’s the answer to “so what?”,

http://www.earth-syst-dynam.net/3/1/2012/esd-3-1-2012.html

Which is exactly what your link says…. duh.

None of these options are “well-established” and they don’t survive back-of-the-envelope calculations. We know how long it takes for electric cars to penetrate the fleet – decades for a meaningful share if and when the technical/cost problems are resolved. I just shot down coal-to-liquids (see above) but for a further reference: http://uu.diva-portal.org/smash/get/diva2:293610/FULLTEXT02

“Third, gasification could be used to replace liquid petroleum gas.”: has anybody done this outside of a laboratory on a meaningful scale? It suffers the same scalability problems as CTL.

‘If the price is right / high enough’ then we will have some of those things. We will also have deep recessions.

Your coal-to-liquids math was dodgy, see above.

Maybe the end of “cheap oil” but not the end of oil. The end of cheap oil is not the end of the car but the birth of the hybrid, cng and electric car. There is no one end all be all to transportation. Our society will continue to use a variety of ways to get around… I hope everyone who comments here understands this.

I hope so too. Again, I don’t mean that peak oil will be the end of the car. Transportation will just get more expensive, which will reduce the amount of people and goods transported.

Two articles on peak oil that should clarify a lot of misunderstandings:

http://physics.ucsd.edu/do-the-math/2011/11/peak-oil-perspective/

http://physics.ucsd.edu/do-the-math/2011/10/the-energy-trap/

Just to put things in perspective. From the Economist.

The Apollo project that brought us to the moon cost the US around $200B in today’s dollars, about 2% of the US GDP at the time. Brazil is starting an oil drilling project that will cost $1,000B, which is a full 50% of their GDP. The oil is 4 miles under sea level.

:( That is an ecological disaster in the making.

Contrarian viewpoint:

The Deep Hot Biosphere

http://www.amazon.com/The-Deep-Hot-Biosphere-Fossil/dp/0387985468

Also known as “crackpot idiot lunatic viewpoint”. Gold does not bring seriousness to anything he does, and there is ample evidence refuting his crackpot views.

Matt – Thank you for bringing up peak oil on this blog. It is a very important issue, but is surrounded with thick layers of emotional responses and propaganda, as seen by the heated discussion above. Know you the stages: denial, bargaining, acceptance…

Many, if not most, Americans want to believe the propaganda fed from the oil/auto industry, since it is comforting, so no one in the mainstream media/political establishment questions it. But the basic statistical fact is that production of conventional crude oil peaked in 2006 (per the EIA). Production of non-conventional oil and other liquids is still rising slowly, due to massive investment. The most commonly reported measure of global “oil” production – “All Liquids” – now includes LPG gas, biofuels and bitumen processed into crude oil.

So what is the impact of peak oil to the US? The annual supply has maximized and after a plateau, begins to drop. There will still be lots of oil for decades to come, but if global latent demand doesn’t drop as fast as production, shortages and price hikes will occur (the world has seen this since 2006 as latent demand grew faster than production). Oil-importing nations that use oil inefficiently (i.e. the USA) will be hurt the most. China’s rapidly growing consumer base can afford oil at higher prices than the US since they use oil more efficiently. High fuel prices or policy need to reduce US demand each year, to allot a greater fraction of the pie to emerging markets, and account for the steadily shrinking pie.

It is true that there are options besides oil for personal motor vehicles. The issue is path dependence. It is already far cheaper to fuel vehicles with natural gas or LPG, but as a nation we lack the ecosystem of equipped vehicles and fuel distribution. Developing that infrastructure will cost many billions and take a long time. From my perspective, those will be lost investments due to eventual natural gas depletion (another topic) and climate change. Eventually we will switch to renewable-sourced electrical vehicles, public transit, and human-powered vehicles. The sooner those investments are made, the better we can adjust to this new era of high oil prices and a destabilizing climate.

Perhaps, anyway one looks at it now, humans are burning fossil fuels at an alarming rate.

I remember my grandfather, born in 1877, died in 1964. Oil consumption at the time of his birth was minimal. I am a lousy 60 years old, and already we are talking peak oil. This is in a relatively short time period that I am intimately connected with.

Does it matter? Who knows?

My opinion? We are squandering the resources, built up over millions of years, at an alarming rate. I guess I will be happy to be deader than a doornail in a few years. What a legacy this immediate past, present, and future generation is leaving. Use it like there is no tomorrow. Hehe.

All the graphs and charts are wonderful. But WE are blowing it, BIG TIME.

@Andrew, While there were many factors that contributed to the severity of the 2008 deep recession, many economists agree that the oil price spike was the catalyst for it.

http://www.theoildrum.com/node/4727 “Jeff Rubin: Oil Prices Caused the Current Recession”

If you classify oil production into conventional versus shale or tar sands vs deep water extraction, then one could reasonably say we have either achieved or are approaching “Peak oil” from conventional sources because the cost of extraction for the other sources is categorically more expensive. The minimum price at which tar sands produced oil becomes feasible is around $90/bbl.

So that does not mean that we are “running out” of oil in the world, it means we are running out of the oil “that we can afford to burn”. Add to that, the ecological imperative that we reduce carbon emissions and we are faced with stark choices.

Jeff Rubin further postulates that at the current trend in oil pricing, the strategy of wage and commodity arbitrage in shipping cheap commodities overseas will collapse. We will be repatriating many industries and we will change how we live. It is the market that will determine this and not government policy. ref: “Why your world is about to get a whole lot smaller” http://goo.gl/aGIyo

And if you have 45 minutes to spare, here’s his excellent talk:

http://youtu.be/wYuLjGQQ-jg

I don’t know the Rubin, but The Oil Drum is peak oil conspiracy theory central.

You capture my issue with “Peak Oil will send us to the 18th century” argument: we can’t afford to burn the oil we have, peak or no. Global Warming is the single largest issue facing humanity, Peak Oil is a distraction.

Well, so far, Rubin has been DEAD ON in his price predictions and price behavior. It is time to get off oil as the engine of our economy. So much of the people who acknowledge that Global Warming is the problem think that we can effect political change. Rubin suggests that market forces will cause us to choose those actions that will limit carbon emissions such as transit versus cars, living closer to work, living in density, manufacturing closer to home markets, local food production. In essence the collapse of global low value commodity trading.

Quite frankly, since Republicans have not allowed any progressive solutions to this problem to take hold, then they (and unfortunately “we”) will be cursed with their vaunted invisible hand.

Amen to that! Sadly a good number of democrats side with them.

So much misinformation here. I don’t fell like responding to every bit of misinformation, so I’m just going to make some points at the bottom of this thread here on a random basis.

First, look at that second bell curve, the one for U.S. oil production. See how at the very end the blue line has turned upwards? It’s almost certain that U.S. oil production will be back up to about 7 M bbl/day within a few years, which is certainly well outside that bell curve. It’s entirely possible U.S. oil production will again reach, or even exceed the previous peak. At any rate, that bell curve is going to be proven to have been inaccurate.

I have also read predictions that world oil production won’t peak until it hits about 120M to 130M bbl/day around 2030, or so. That remains to be seen. However, it is very obvious that world oil production is continuing to increase and is nowhere “peak” levels currently.

Wrong. Read the Deutsche Bank report.

http://finance.yahoo.com/news/gas-price-highs–refiners–lows.html

“In December, Americans drove 264.4 billion miles, up 1.3% from the year before, but did so using 2.5% less gasoline and diesel, according to data from the U.S. Department of Transportation and the Energy Information Administration.”

So VMT was up 1.3%, but gasoline and diesel consumption was down 2.5%. This suggests and increase in fuel efficiency of about 3.8% in just one year. There is no reason why this trend won’t continue in the U.S. for the next couple of decades, at least. In the year 2000, the average new car sold in the U.S. got about 23 mpg. In 2025 the average new car in the U.S. is supposed to get 56 mpg. As older, less efficient cars are junked, and new, more efficient cars replace them, the U.S. average mpg will increase significantly every year.

It certainly looks like the U.S. is going to increase it’s average motor vehicle fuel efficiency by more than just 1 percent per year, as someone wrote here.

Fuel efficiency is limited by the efficiency of small internal combustion engines, which is hitting the wall.

If you want to know the maximum efficiency, look at a diesel-electric serial hybrid; that’s as good as it gets. Then there is no improvement.

We’ll get a large increase in fuel efficiency by switching to plug-in electric cars, however.

http://www.forbes.com/sites/timworstall/2011/10/19/peak-oil-entirely-nonsense-as-is-peak-gas/

“Peak Oil, Entirely Nonsense: As is Peak Gas

“The Earth’s crust is riddled with fossil fuels. The issue is not whether there is a shortage of the stuff, but the costs of getting it out. Until recently, the sheer abundance of low-cost conventional oil in places like the Middle East has limited the incentives to find more, and in particular to go after unconventional sources. But technical change has been driven by necessity – and the revolution in shale gas (and now shale oil, too) has already been transformational in the US, one of the world’s biggest energy markets.

“And to make the point more directly. Once we invent a new technology to extract oil or gas (or indeed any other mineral you might like to think of) this does not mean that we’ve just found that one new field that we’ve developed the new technology to extract oil or gas from. It means that we’ve just created a whole new Earth, an entire new planet that we can prospect for similar deposits that can be exploited with the new technology.

“In fact, what seems to be becoming a consensus among some geologists is that shales are abundant (oil shales come from terrestrial plants, gas from marine) and what we’ve been thinking of for a century or two as oil or gas deposits are just those few places where geology has done the fracking and collection for us already. Now that we’ve developed fracking, to do what geology hasn’t done in the far more numerous shales, there just really isn’t any long term, long term meaning century or more, shortage of oil and or gas.”

Your quote proves Rubin’s point. It’s not that there isn’t enough oil, its whether we have enough of the oil that we can AFFORD to burn. The cost of extraction for shale and tar sands is astronomically higher with devastating ecological effects that must be accounted for. We are headed for $200/bbl oil pricing. That translates to $7/gal gas. That will be well before Detroit, Stuttgart or Tokyo can produce cars with 50+/mpg fuel efficiency to net the cost back to what we’re paying now.

At those prices, people in exurbs will leave and move closer to urban centers. People in cities will leave their cars at home and take public transit more often. All of these trends will happen without a government telling you to do so.

You are completely wrong. Oil from shale and deep wells costs only about $60 per barrel to produce, and that cost will likely fall as they keep getting better at it. $60 per barrle oil translates into about $2.50 per gallon gasoline, which is about the average price of gasoline over the last 90 years in 2012 dollars. We are going to see gasoline back down to around $2.50 per gallon in the U.S. in a relatively short time. If the sanctions against Iran are lifted, then the price of oil is going to collapse.

At $7 per gallon gas, how much would public transit cost? Cars are much less expensive to operate than transit in our area. Even at $7 per gallon gas — which is not going to happen, or even come close to happening — the operating cost of a car per passenger mile is a lot less than Link light rail or a Metro bus.

You’re wrong about the price of shale oil and deep oil, and that’s even *before* you consider the fact that they’re getting the current prices by means of ignoring safety and environmental regulations, something which will not be tolerated forever.

By the way? The operating cost of a car is more per passenger mile than Link light rail, already.

LOL The operating cost of Link light rail is about 75 cents per passenger mile. The operating cost of an average car in the U.S. is about 23 cents per mile with gasoline at $4 per gallon.

If you use 1.6 as the typical number of passengers per car overall, in the U.S., then you get about 14 cents per passenger mile as the operating cost of the average U.S. car at $4 per gallon gas.

A small car in the U.S. costs about 19 cents per vehicle mile to operate with gas at $4 per gallon, or around 12 cents per passenger mile.

So, the operating cost of Link light rail is about FIVE TIMES as high as the operating cost of the average U.S. car with gas at $4 per gallon, or about SIX TIMES as high as a small car in the U.S. with gas at $4 per gallon.

Norman … you say that Link is 75 cents/passenger mile … using your calculations of decreasing the amount by the number of passengers … so with 10 people on board that would be 7.5 cents / mile … with 75 people on board that would be 1 cent / mile, etc …

Here’s a calculator for determining a reasonable cost per mile and annual cost to drive. I’ve inputed values that led to about 12,000 miles per year and that led to a direct cost of $1.02/mile and if you add in their identified “indirect” costs, it goes up to $1.41/mile to drive. Certainly more than your laughable $0.23/mile. While you might legitimately quibble with a few of their categories, their methodology over all is sound.

http://commutesolutions.org/external/calc.html

The list of sources used: http://commutesolutions.org/external/calculator-resource-list-2009.html

Further Norman, we have shown you here time and time again, CAR TAXES OR FEES DO NOT PAY ALL COSTS FOR ROADS OR PARKING but you keep trying to make that claim that they do.

Gordon, the 75 cents per passenger mile for Link is for whatever Link is averaging per trip right now. That already does take into account how many passengers are on each Link car. lol

The operating cost per VEHICLE MILE for Link is way over 75 cents.

I am comparing operating cost per PASSENGER MILE for Link to operating cost per PASSENGER MILE for cars. This is an accurate comparison.

What you are attempting to do, I have no idea.

Charles, I am comparing the OPERATING COSTS of cars to Link.

OPERATING cost of cars and Link does not include depreciation, or any other capital costs. The OPERATING cost per mile I used for cars is right from the AAA “Your Driving Costs” 2011 Edition.

The figure you made up includes depreciation, and all kinds of other garbage. If you include depreciation for Link, you come up with a number over $2.00 per passenger mile for Link.

But, my figures for comparing OPERATING COSTS, and not including capital costs for either mode are quite accurate.

http://seattletimes.nwsource.com/html/businesstechnology/2017793790_istat20.html

“”We are in a bubble,” Adam Pilarski, a respected industry analyst with consulting firm Avitas, told his audience of airplane lessors and financiers.

“Pilarski made one further projection that, if realized, would definitely worry Boeing. He gave a detailed argument that oil prices, currently at $108 per barrel, are artificially high.

“He said there’s no scarcity of oil and the price is not rational; instead, it’s affected by short-term political judgments. He forecast it will drop drastically in the medium term, as low as $40 per barrel by 2018.”

http://finance.yahoo.com/news/crude-steadies-fall-crude-stock-002444763.html

“Saudi Oil Minister Ali al-Naimi blasted “irrationally” high oil prices in an opinion piece in the Financial Times,

“With Iran’s oil exports facing the threat of tightening sanctions, Saudi Arabia is expected to have a record 140 oil and gas rigs operating by the end of the year, industry sources said.”

http://finance.yahoo.com/blogs/daily-ticker/4-gas-no-justification-high-prices-says-fmr-160209651.html

“$4 Gas: “There Is No Justification” for High Prices, Says Fmr. Senator Dorgan”

Dorgan says high price of oil due to speculation — not supply and demand.

Dorgan is all hat and no cattle. Speculation accounts for a small fraction of the price. The price of oil is set globally and global demand is what is driving it.

What would Sen. Dorgan have the President do? “Invent” a reason to invade an oil rich country and steal their oil?

You are wrong. Speculation about the loss of oil exports from Iran because of the sanctions against Iran is what has caused the current spike in oil prices. Speculators are betting that oil exports from Iran are going to decrease due to sanctions, which will drive up the price of oil. This could happen, but that possibility is already built into the price now. If the Iran situation is resolved, and Iran’s oil exports are not significantly reduced, the price of oil will collapse back to around $70 per barrel, or so, from the current $120 per barrle for Brent crude.

You are wrong, Norman. Yes, there IS a speculative bubble, but it’s ON TOP OF a secular price increase.

Read the Deutsche Bank report.

It has been shown that demand destruction results in contractions of oil pricing but it is still trending upwards. e.g. every time there is a bust, the average floor is still higher than before.

Exactly. The Deutsche Bank report lays this out in detail for the benefit of investors trying to predict future prices.

It has been shown where, and by whom? The price that matters is the price of gasoline. Here is an inflation-adjusted price of gasoline chart for the U.S. from 1918 to 2012:

http://inflationdata.com/Inflation/images/charts/Oil/Gasoline_inflation_chart.htm

The only really major price spike was from about 1971 to 1981. The price of gas during that spike reached $3.37 in 2012 dollars. After tha spike, the price of gas fell to its all-time low of $1.50 per gallon in about 2000.

You could also say there was a price spike in the 1930’s, when oil was also over $3.00 per gallon in 2012 prices, but the price then fell back below where it was before that price spike.

So, how can you say that “every time there is a bust, the average floor is still higher than before”? Based on what? You mean if you don’t adjust for inflation? lol

We are still in a price spike that started about 2002. What has resulted from this prolonged period of relatively expensive gas is a move towards much greater mpg cars, and the invention of fracking and deep-sea oil wells, which has greatly increased the amount of oil which is recoverable. Both of these things are just at the very beginning stages. If you think they both won’t put great downward pressure on gasoline prices over the next couple of decades, then you will just have to wait and see what happens.

From the Financial Times:

The Wall Street Journal – That bastion of Conservative neo-journalism — in addition to the above Financial Times article raised the spectre of oil prices causing recession. Here is a link to a chart attributed to them:

http://goo.gl/4SKvj

And here is a link to the Deutsche Bank report that Nathanael was referring to:

http://goo.gl/m2Yf2

America is going to be in for a BIG culture shock within the next couple of decades. Eventually fuel prices and the high profit margin extracted by the oil companys will exceed the the $4.50 or so “soft cap” that really seems to dictate vehicle miles traveld, and in what types of vehicles (remember a couple years ago where VERY large trucks and SUVs were getting scarce on the roads?). Problem is this will be met by our nearly destroyed public transportation systems (Amtrak, Greyhound, and Local and regional transit agencys barely hanging on, Full buses and trains, more demand than there is service and no money to provide extra, P&R lots full, etc). I think now is the time that Sound Transit and partner agencies need to find additional funding sources to invest in things like Sounder “feeder” shuttles, more P&R capasity, etc. When people are spending more and more on fuel and transportation, our economy will suffer, which will drag our current government funding woes even further down.

Improvements in bike access would be far cheaper in many cases. I’m not talking bike paths everywhere. Start with low hanging fruit and work your way up. The Kirkland leg of the BNSF corridor should be a slam dunk.

Transit in our area is so stupidly expensive, it is the massive amounts of tax revenues wasted on subsidizing transit in our area which is going to drag our government funding woes even further down. The 100mpg equivalent electric cars, and 50mpg-plus gasoline and diesel cars are going to be far less expensive to operate than the incredibly expensive transit systems in our area.

Besides peak oil there’s also the amount of oil per person. Oil discoveries have gone up over the past decade but the number of people switching to active oil consumption (e.g., buying cars) vs just passive consumption (e.g., buying oil-produced food) has outpaced it. From Jeremy Rifkin, “The Third Industrial Revolution”.

Also, regardless of peak oil, it’s ridiculous to have cities dependant on cars. Transportation infrastructure should be balanced so that people can have a real choice between driving and transit. Of course people drive when transit is ten times less convenient in some places. The early visions of suburbia assumed the existing transit infrastructure would remain intact: long-distance trains, commuter trains, frequent local transit. What happened instead is that these were neglected. Improving transit in the US is about filling in the gaps, restoring it to the point it would have been if these hadn’t been neglected. This is worthwhile regardless of whether peak oil is immanent.

In our area, that is just stupidly expensive. The insane tax subisidies for Metro and Sound transit are not sustainable. The cost per passenger mile of Metro or Sound Transit transit systems is a few times the cost per passenger mile of driving a car, not to mention van pools and car pools.

Transit in our area is just stupidly and unsustainably expensive. It is not sustainable, because it costs way too much.

The insane tax subsidies on your asphalt-and-oil road system are what’s not sustainable. Stop paving the roads, and you’ll see how cheap Link really is….

“It is not sustainable, because it costs way too much.”

By that metric nothing is sustainable.

Roads in our area cost a fraction of what Link light rail lines are costing, and those roads carry far more people than Link light rail carries. There is no contest. Plus, the cost of the roads comes out of the cost of gasoline. When you pay $4.00 per gallon at the pump, over 50 cents of that is tax, which goes to pay for roads (and unfortunately, also goes to subsidize the stupidly expensive trains).

The fact is that the taxes, fees, and tolls on motor vehicles pay for the roads. But transit is almost completely subsidized by general taxes, including taxes on motor vehicles!

The cost per passsenger mile of transit in our area is multiple times the cost per passenger mile of motor vehicles. It is not even close.

Norman, it simply isn’t physically possible for everyone to drive everywhere for everything. Even if every dime spent on transit or bikes went to roads. There isn’t room for everyone on the roads at peak periods and there isn’t room for them to park once they get there.

Beyond that most people find the sort of built environment that results to be rather ugly and soulless. Furthermore those too young to drive, those physically not able to drive, or those too poor to afford it end up SOL when it comes to mobility for meeting daily needs.

I guess it is lucky that crude oil was discovered. Otherwise, how many whales do you think would be left swimming in the sea? I imagine that it is a good thing “whale oil” lamps are a relic in antique stores. Good for the whales, that is.

Humans have a sad tendency to squander every “resource” they come in contact with.

And, yes. I am included. I think I am human. Though Norman might disagree, just for the hell of it. LOL

Well, the Greeks knew about electricity (electric eels) but never saw its practical potential. Likewise, a society without crude oil would not think of using limited whale oil for cars or fertilizer on a mass scale — the whales would have gone extinct before it got off the ground.

The early car designers tried a variety of fuels and engine types before settling on gasoline engines. Perhaps without cheap crude oil they would have built electric cars sooner, or vegetable oil cars. Perhaps then only the rich would have cars now. Of course, it’s impossible that nobody in the following hundred years would have gotten around to crude oil, as it was spontaneously bubbling up out of the ground.